ALERT: BEWARE OF BANK IMPERSONATION CALLS, TEXTS AND EMAIL

Please note that the banking industry has observed a concerning rise in impersonation scams that aim to take over bank accounts and steal money using Zelle, ACH or wire. Before you provide any information to an email request, text or phone call, please make sure you know the identity of anyone requesting information or call our Client Care Center at 877-770-2262 for verification.

BUSINESS PLANNING FOR UNCERTAIN TIMES

Playbook for Success in a Risky World

Carlos Ramos

EVP, Middle Market Banking Group Leader

Yes, the future is uncertain. But that does not mean a plan is useless.

We spend a lot of time working on forecasts with clients, and typically they are quite useful. Quarter-to-quarter results may be different than expected, but the annual assumptions generally tend to hold. Most companies should be planning three to five years out, giving them time to line up capital and build the resources and talent necessary to execute their strategy. However, we are often asked: “How can we plan in such an uncertain environment?”

The truth is that the future is always uncertain. If you are planning to grow at a pace faster than that of the market, your competition may respond in a way you have not yet anticipated. Simply participating in a market changes its dynamics. That does not mean you cannot establish a game plan.

If you watch football, you will notice the head coaches studying a laminated card that represents the game plan for the day.

Do you ever wonder why they are still looking at it when losing by 20 points? It is useful because it holds more than the day’s game plan. It also includes a variety of alternatives they have practiced.

If your game plan is not effective, you will have to adjust. Your ability to react quickly, however, will be limited by what you have practiced (or thought through). Strategic business planning should include options that could be executed if the tactics are not working as expected.

If you plan the next three to five years based on everything you do know and can control, you will be surprised at how much can be anticipated. When things do not go as expected, you will manage the situation much better if you have thought through a number of different scenarios and the options you have available should any of them develop.

Plan What You Can

Start with a financial forecast including balance sheet, income statement and cash flow. Build a set of assumptions that will drive the line items of your financial statements in as much detail as you can. For instance, sales growth of 10% is not as useful as knowing the number of new orders and average selling price that comprise that growth. There can be many controllable variables inside a simple growth percentage.

Run through the variables and determine a most likely (“base” case) scenario. Then test the variables against those assumptions. What does the financial performance look like with faster or slower sales growth? Higher or lower costs? Do you have the resources to make the base case or upside case a reality? Do you have the resources to survive the downside assumptions?

Expect the Unexpected

No one is in a better position to predict the next few years for your company than you. However, that does not mean you cannot, or should not, consider how your company will perform if hit with an unexpected shock.

Once you have set up a model that can demonstrate the financial consequences of changing assumptions, start by entering the system shocks that keep you up at night. For example, a sudden loss of a large customer, a supplier going under, manufacturing or shipping delays. Once the model has been “shocked” with an unexpected event, you can see the financial impact, determine how much time you have to correct it and consider the other variables that need to change to restore the performance.

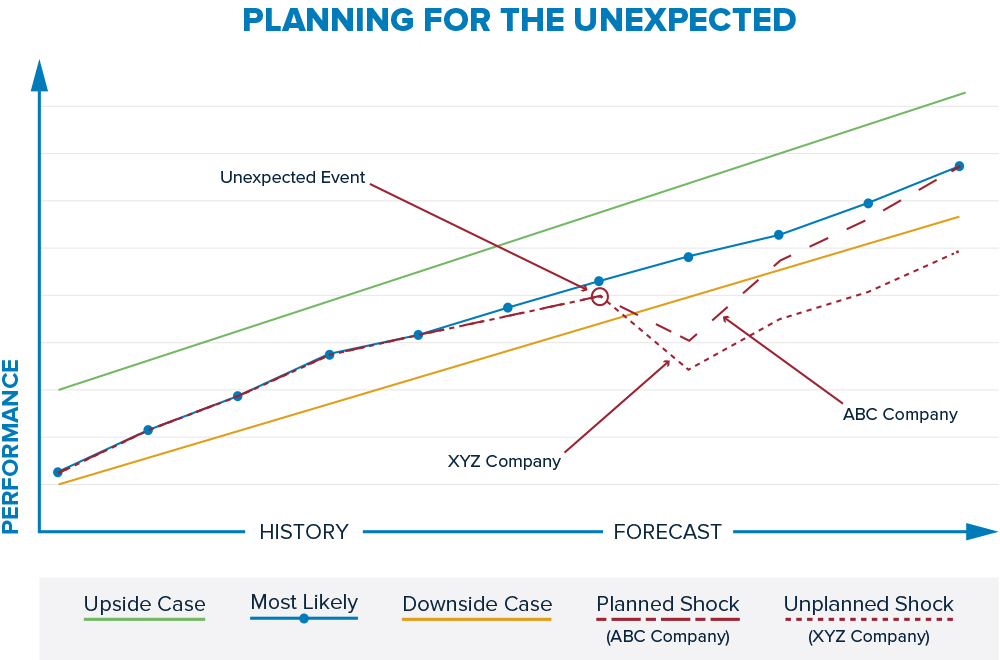

The chart below represents a performance forecast with the most likely scenario running smoothly up and to the right. That performance is bracketed with upside and downside cases. Many companies do not forecast the upside case, and that is a mistake. Faster growth than expected can strain a company’s liquidity and stability as easily as a drop-off in demand. Make sure you are prepared for both scenarios. The chart also plots the performance of two different companies when hit by an unexpected market disruption. One company had planned for an exogenous shock and the other had not.

ABC Company implemented a plan that conserved cash flow. They reduced the work force, exited marginal markets and deferred spending. XYZ Company had no such plans and was slow to respond, waiting for better clarity to emerge. They started planning for the emergency while in the middle of it. There was insufficient information on where or what to cut.

As a result, a liquidity crisis developed. Bankers/other investors started to exercise control over the plan and process. This slowed everything down, exactly when agility and speed were most needed. XYZ Company did not have a play ready to call. The performance deterioration was more severe and lasted longer.

ABC Company had an emergency plan and metrics that defined what constituted an emergency. In other words, they had practiced a play in case the most likely game plan was no longer relevant. Today, ABC Company has recovered their market share and gained a reputation for reliability in the face of uncertainty.

Stop Worrying and Start Planning

We were asked recently how to balance “analysis paralysis” against action. Delay caused by more detailed planning is not the problem. The real risk is paralysis in the face of unexpected market changes.

Plan for the most likely scenario. Test the upside and downside linear performance, but have a play or two to address the unexpected. You do not have to anticipate everything that could cause a crisis because the details really do not matter. Regardless of what takes you outside your expected performance zone, the response should almost always be the same: Maximize cash flow.

At Banc of California, we provide planning assistance to our clients as part of our service, at no additional charge. We believe we succeed by making sure our clients thrive. In financial analysis, risk is defined as uncertainty. We cannot eliminate unpredicted market shifts, but we can help clients prepare to respond. As mentioned earlier, your game plan is not the limiting factor on the game card. You are limited by what you have failed to prepare for or practice.

Most entrepreneurs lie awake at night worrying about what might happen. That is wasted anxiety. Better to write down your concerns, test their financial impact and determine what you could do about it while you still have the luxury of time. If you can dream it, or worry about it, we can model it.

For more information, visit bancofcal.com

DOWNLOAD ARTICLE

Business Planning for Uncertain Times

CONNECT WITH A RELATIONSHIP MANAGER

COMPLETE THIS FORM OR CALL

877-770-BANC (2262)