ALERT: BEWARE OF BANK IMPERSONATION CALLS, TEXTS AND EMAIL

Please note that the banking industry has observed a concerning rise in impersonation scams that aim to take over bank accounts and steal money using Zelle, ACH or wire. Before you provide any information to an email request, text or phone call, please make sure you know the identity of anyone requesting information or call our Client Care Center at 877-770-2262 for verification.

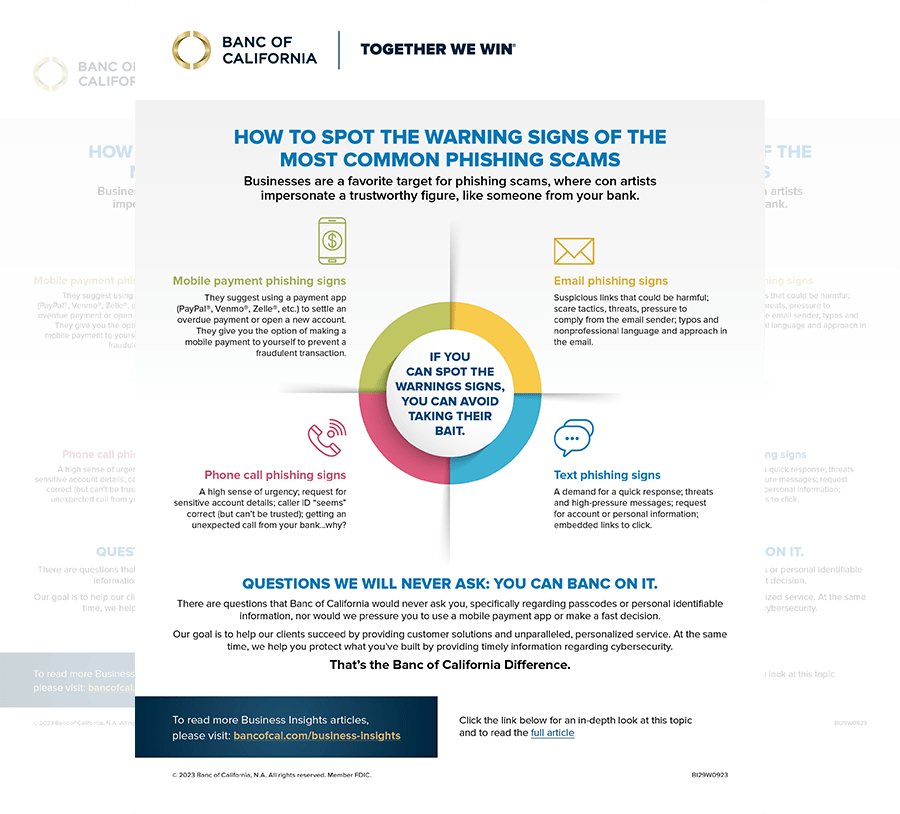

FOUR WAYS YOU CAN GET HOOKED

BY A PHISHING SCAM

Frank Schmahlenberger

SVP, Chief Information Security Officer

For scammers, it’s always “phishing season,” and they’re constantly looking to hook business owners and employees with four unique scams.

Business owners are always intently focused on running their company or organization successfully—so much so, many rarely think about cyber thieves and scammers that may be trying to steal money or information.

That needs to change. Scamming is a serious business, as statistics show:*

- In 2022, consumers lost $8.8 billion to scams.

- That amount represents a 30% increase from the year before.

- Businesses are a major target for cyber thieves.

- Phishing scams are a significant portion of the losses.

What is a phishing scam?

Phishing scams involve a con artist pretending to be someone from an organization you know and trust.

More and more, scammers are pretending to be from the company’s bank or financial institution.

In other words, scammers will reach out to you or your employees, saying they are with their business bank. If they manage to gain the trust of (or simply fool) the person they’re talking with, their scam has a chance of succeeding. Scammers count on their victims being busy, helpful and trusting, so the scam can take place quickly with no problems along the way.

Scammers will reach out in one of four ways to start their phishing scam expedition:

- By email

- Through a text message

- With a phone call

- With a mobile payment app suggestion

However, if you’re aware of the types of phishing scams—and learn the warning signs for each—you stand an excellent chance of stopping a phishing scam even before it starts.

HERE ARE THE RED FLAG WARNING SIGNS OF PHISHING SCAMS.

Email Phishing Scams

Scammers are clever enough to imitate or “spoof” familiar email addresses and hide their own. According to reports, email scams account for more than 90% of all phishing scams. In fact, in the business realm, the impact of phishing email scams is referred to as BEC phishing, for Business Email Compromise.

Warning signs of an email phishing scam.

What to watch for when you receive an email from your bank:

- Suspicious links. In fact, start looking at any link you receive in any email as untrustworthy. Examine every link carefully or avoid clicking on the link at all.

- Scare tactics, threats, pressure to act. The email could start out with startling news (“Your account has been frozen”) and make harsh demands, such as “make a payment immediately” to avoid more problems.

- Typos and nonprofessional language. Banks have teams of professionals who send communications. If the wording and sentences seem abnormal, it might indicate it’s from a scammer.

The best tip to stay safe: Take time to examine every email closely and double-check the sender’s email address if something looks suspicious. Also, take time to learn how to prevent Business Email Compromise.

Text Message Phishing Scams

In recent years, companies and authorities started coming down harder on email scammers. Feeling the heat, the con artists shifted schemes to text messaging. They found great success, especially during the pandemic, when we were texting more than ever.

Warning signs of a text message phishing scam.

What to watch for when you receive a text message from your bank:

- There’s a link in the text. That’s a huge clue and red flag that something could be wrong.

- A demand for a quick response. Scammers don’t want you to pause and think. They hope you just react the way they want you to.

- Threats and high-pressure messages. That’s not how any bank or business operates. Learn never to respond to messages with that kind of high-pressure language.

- Request for account or personal information. This is a major red flag. Banks will never randomly reach out and request account or other information.

The best tip to stay safe: Be suspicious of ANY text message coming from your credit card company or bank randomly. Never click on links to continue the conversation.

Phone call phishing scams

If there’s one way a phishing scam might sneak in, it could be through a phone call. Scammers can manipulate callers cleverly, and with a well-written and rehearsed script—and a caring, helpful tone—it takes only a minute to snag a victim.

Warning signs of a phone call phishing scam.

What to watch for when you receive a phone call from your bank:

- A high sense of urgency. You’re told there’s a serious problem you need to take care of ASAP.

- Request for sensitive account details. No bank will ever ask for sensitive account details, even if there were an issue.

- Caller ID…it can’t be trusted. Scammers are clever, so don’t trust your eyes if the phone number “looks” right. Trust your instincts.

- A phone call from your bank! That in itself should be a warning sign, and your scam antennae should be up.

The best tip to stay safe: If you’re not expecting the call or don’t know the caller, just hang up! If you’re curious, call your bank or relationship banker directly.

Mobile payment app scams

Scammers adapt to all technologies where payments and money are concerned. They’ve designed scams and stories that pressure victims to satisfy overdue payments or taxes using payment apps such as PayPal®, Venmo®, Cash App®, and Zelle®.

Warning signs of a mobile payment phishing scam.

What to watch for when your bank talks about a payment app:

- They advise you to make a payment to yourself. The biggest giveaway of the scam is the advice to use the app to pay yourself as part of the solution.

- They ask you to send money. Banks don’t ask customers to send money to any person through a mobile app. They will also not ask you to make a payment that way.

- They ask for your login information. After lying about an account problem, a scammer will try to obtain your bank account number and login credentials to help you.

The best tip to stay safe: Open a mobile payment app only by yourself and keep transactions between family and friends or businesses you know who accept payments via a payment app—and never fall for the idea of “making a payment to yourself.”

THERE ARE QUESTIONS WE NEVER ASK.

There is one key point we want to stress: Banc of California will never ask you certain questions regarding your account, or ask you to make payments or transfers to solve a problem. That’s not how Banc of California does business.

We encourage you to trust your instincts whenever you get a text, phone call or even an email with a message or request that doesn’t seem 100% right. Hang up, or delete the text or email. And If you know the phone number of your Relationship Manager, give them a direct call.

We will always be there to make sure your accounts are protected. That’s the Banc of California Difference.

*FTC.gov.news-events

DOWNLOAD INFOGRAPHIC

CONNECT WITH A RELATIONSHIP MANAGER

COMPLETE THIS FORM OR CALL

877-770-BANC (2262)